Table of Contents

Changing careers is an emotional process. It requires a lot of motivation, effort, self-confidence, and hope. However, career transition also requires sufficient financial resources. Whether you have a job or not, you have to eat, live, and survive. While we can always hope to get a job as soon as possible, there is no guarantee when this will come.

In fact, according to the Bureau of Labor Statistics, the median unemployment duration in May 2021 was 19.3 weeks or about 5 months. So it is important to have sound financial backing during a career change process. In this article, let’s look at some top financial tips to help you in a smooth career transition.

1) Start looking for a job while you are still employed in a full-time role

One of the best ways to manage finances while changing a career is to look for a job while still employed. While this sounds chaotic and stressful, it serves multiple purposes. First of all, it ensures a constant stream of income. Secondly, it avoids any potential employment gaps that may be questioned by your future employers.

Having an actual full-time job will keep you busy with work while letting you spend the required time on your job search. However, we understand job search for a full-time job can be challenging. Let’s discuss some tips to support you through the process.

- Determine a suitable job search strategy. Based on your schedule, decide on the time and days you want to spend on your job search. For example, one hour every day or two hours every alternate day.

- Reach out to your ex-colleagues and classmates. However, avoid talking about your job search at your current workplace. Make sure you do not look up any job search sites or other resources during your work hours. It poses a risk of burning professional bridges when you’re caught red-handed doing this.

- Network with the right people strategically. Being currently employed in a job is a huge plus as you already have an active network. Identify the relevant people and reach out to them with your networking pitch.

- Update your resume, cover letter, and LinkedIn profile. Make sure it is aligned with your target role, company, and industry. In addition, customize your career documents for every job that you apply for. However, this doesn’t require you to publicly post about your job search on LinkedIn.

- Use former employers and colleagues as references. Putting down your current employer on your reference list can impact your relationship with them. It is safer to request a reference from people not directly involved in your current role.

2) Look for part-time roles

If you have recently been laid off and are looking for a new full-time role, an emergency part-time job can be a suitable financial solution. This will allow you to have a recurring income while you work towards landing your dream role. Any role that requires you to work less than 35 hours a week is classified as a part-time role. In most cases, such jobs provide you the flexibility to adjust your work hours based on your needs. Additionally, a part-time role may not necessarily require a specialized degree. Some examples of such part-time roles include:

- Recruiting Professional

- Tutor

- Content Creator

- Business Consultant

- Project Manager

- Social Media Analyst

- Team Lead

- Marketing Specialist

That said, if you are changing the industry, we strongly recommend taking up a role in your target industry. This will help you gain experience while strengthening your resume. Another option could be taking a role similar to your desired role. This will allow you to optimize your transferable skills in your new role and build a stronger business case. A part-time role is a great tool to support your job search too. It demonstrates your ability to multi-task, manage time efficiently, and keep yourself motivated. Some top websites that you can use to identify relevant part-time roles are:

- Upwork

- Fiverr

- Freelancer

- CoolWorks

- FlexJobs

- Craiglist

- Guru

3) Create a personal budget

A budget allows you to record and manage all your incomes, expenses, and savings. Creating one will help you figure out your expenses, especially the ones that you would be required to cut down on when you are in the middle of changing jobs. To create a budget, you don’t have to be a professional. All you need is to have the required information and a rough idea of how to go ahead. To help you with this, we have summarized an easy way of creating a personal budget below.

- Collect all the required documents that reflect your income, expenses, and savings. These would mainly include your bank statements, investment information, savings account details, credit card bills, receipts, and more.

- Based on the above, calculate all your income. Then, compute your expenses and identify the fixed and variable ones. Note these down in a spreadsheet.

- Use the variable and fixed expenses you compiled to help you get a sense of what you’ll spend in the coming months. Make adjustments if necessary and review your budget on a regular basis to stay on track.

Some budgeting tools that you can use for ease and convenience are:

4) Start a savings fund

Career change won’t happen instantly. In most cases, searching for and securing a new job takes time. So to make sure you have sufficient financial resources to support your career transition, start a savings fund. A savings fund or an emergency fund is money set aside for any unexpected expenses that may happen in the future. This saves you from borrowing money in the hour of need. Even if you end up borrowing some funds, the amount is much lower because you already have a portion set aside.

Generally speaking, try and save three to six months’ worth of your living expenses. As a rule of thumb, we suggest following the 80-20 plan or the 50-20-30 rule. This means saving 20% of your earnings while spending 80% of it in the former plan and 50% on essentials and 30% on others (non-essential) in the latter rule. It will ensure that you save a fixed amount of salary every month to help you in the future. We encourage you to deposit this in a savings bank account every month. It will earn you some interest in your savings.

5) Reach out to a personal finance coach

Financial decisions aren’t always easy to make, especially when you don’t have a finance background. While you can always find enough information on the internet, it is a good idea to consult a financial coach to help you with your financial planning. A personal finance coach supports you to make decisions aligned with your financial goals and cultivate healthy financial habits in you. Let’s look at some benefits of working with a personal finance coach below.

- They help you overcome your fear of handling money

- They help you manage your debts

- They address any misconceptions and poor practices around money management

- They provide you with the right information to make decisions on spending and investments

Some finance coaches/agencies that you can reach out to are:

- Financial Fitness Coaching

- Ramsey Solutions- Financial Coaching

- The Financial Gym

- Dorethia Kelly

- MoneyMindful

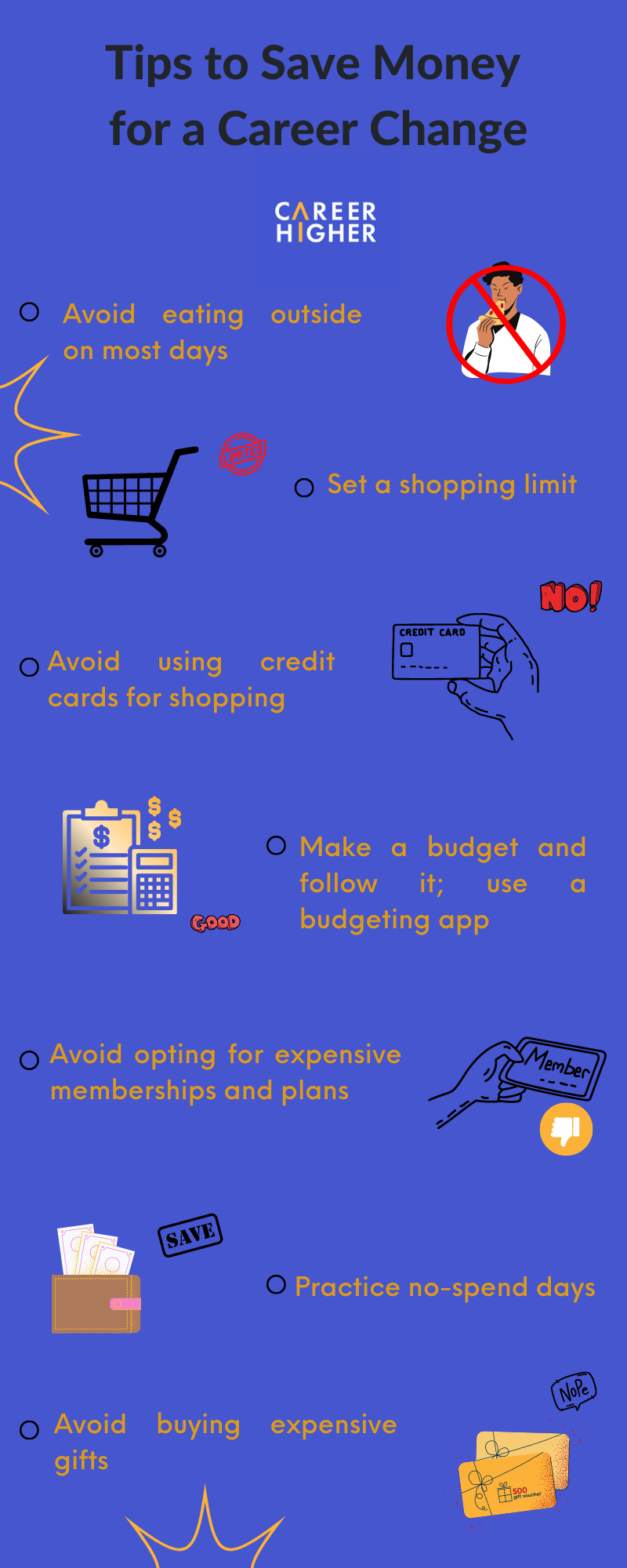

6) Cut down on expenses

In most cases, a full-time job brings financial independence. This enables us to take actions that bring us closer to our desired lifestyle. However, when we are looking to save, it is necessary to cut down on unnecessary expenses to optimize the financial planning process. Again, identifying what counts as unnecessary expenses without bias may be challenging. So we suggest thinking about the following:

- Does it bring you value or enjoyment?

- When was the last time you used it?

- Will it make a difference if you don’t spend money on it? If yes, what?

Once you have had a basic understanding of the above questions, it will be easier for you to identify unnecessary expenses. We encourage you to be honest with yourself and see what expenses can be avoided based on your lifestyle. Having said that, avoid following someone else’s advice based on their lifestyle. Ensure that you only go for unbiased advice, such as that of a professional coach or advisor. Now let’s look at some unnecessary expenses that can be avoided or reduced in most cases.

- Memberships and Subscriptions

- Eating out and shopping too frequently

- Expensive internet and cable plans

- Costly gifts

- Personal services like lawn care, manicure and pedicure, and haircuts

Some tips to keep in mind while trying to save are:

- Cook most of your meals at home

- Create a shopping list and stick to it

- Set a shopping limit

- Use a budgeting app

- Use electricity wisely

- Carpool wherever possible

- Track your expenses

- Avoid using credit cards to make payments

- Have no-spend days

Tips to save money for a career change

Money is an important aspect of changing careers. Hence, financial stability is essential when you are thinking about moving to a new job. If you are not financially sound, it may be a scary thought to change careers. However, if you follow the above advice and seek professional help to manage your money, you can most certainly make it through.